Mutual Funds

Mutual Funds

Mutual Fund is an investment scheme managed by professional asset managers. The managers to the fund allocate and invest an investment corpus contributed by multiple investors who share common financial goals. The corpus is invested into various financial instruments based on a pre-decided criteria and objective of the scheme. The investors can choose a fund according to his / her preferences and risk appetite, holding specific units of the fund in their name in proportion to the amount invested by them. It is an attractive investment option for retail investors as it offers opportunity to diversify risk across multiple securities as well as pay a low cost as charges for fund management.

Investors in a mutual fund own units that represent a portion of the fund’s holdings. Mutual funds are categorized based on their investment strategy, such as equity funds, debt funds, hybrid funds, or sector-specific funds. They offer advantages like diversification, professional management, and liquidity, making them a popular choice for both novice and experienced investors. Mutual funds come with varying levels of risk, depending on the type of fund and the underlying assets, and are typically subject to market risks.

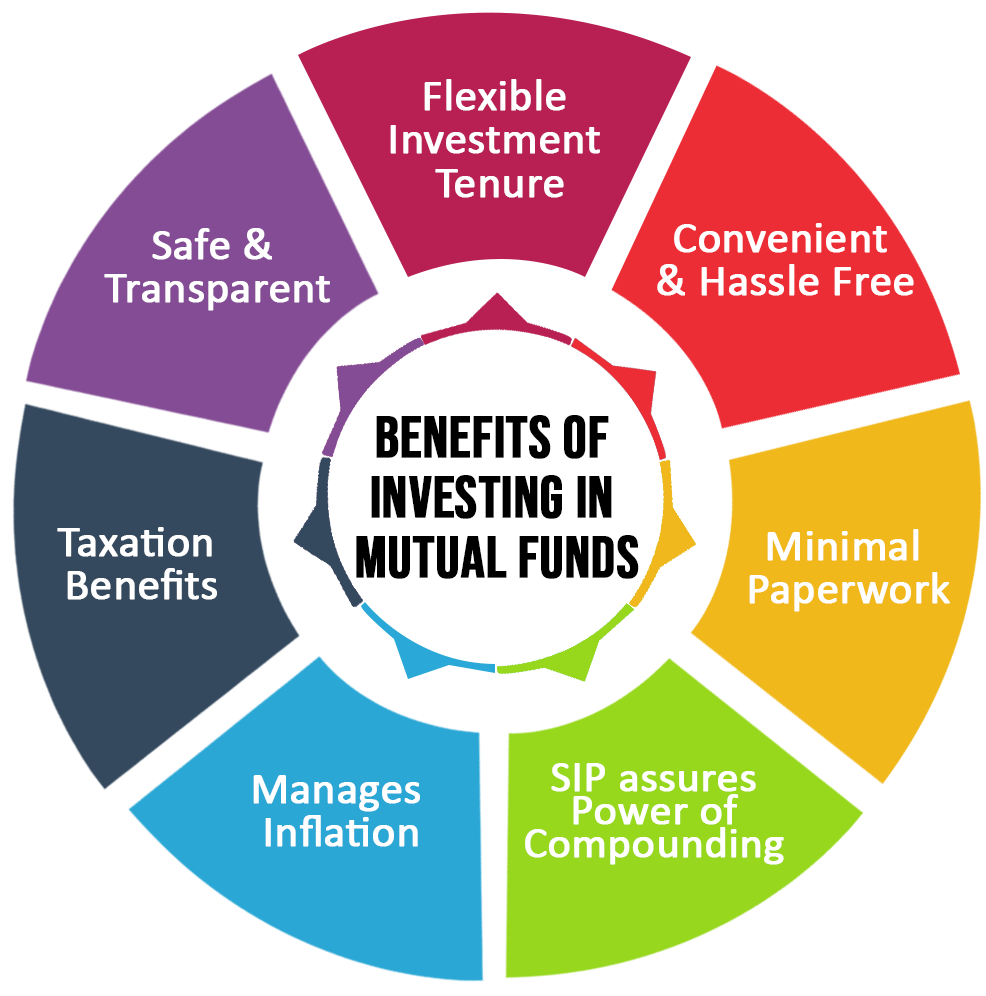

The advantages of investing in a Mutual Fund are?

- Professional Management

- Diversification

- Convenient Administration

- Return Potential

- Low Costs

- Liquidity

- Transparency

- Flexibility

- Choice of schemes

- Tax benefits

- Well regulated

TYPES OF MUTUAL FUND SCHEMES

By Structure

Open – Ended Schemes

Close – Ended Schemes

Interval Schemes

By Investment Objective

Growth Schemes

Income Schemes

Balanced Schemes

Money Market Schemes

Other Schemes

Tax Saving Schemes

Special Schemes

Index Schemes

Sector Specific Schemes

Mutual funds

- Buy / sell mutual funds in the same way as you trade in share market.

- Get your mutual funds dematerialised and have a consolidated view of all your holding in equity and mutual fund.

Benefits of Mutual Funds in Demat

- No hassles of signing application forms for every purchase or redemption.

- Complete data of all the years will be covered in a single demat statement that is made available through R. Wadiwala

- Single point of contact at R Wadiwala for all your requirements.

- Stay updated with your latest valuation on a phone call or by using our mobile app or website

Stay ahead in a rapidly changing world. Subscribe to Betaone Fintax LLP Newsletter