International Tax Services

international tax services

With globalization comes a complex web of international tax laws and regulations that companies must navigate to streamline their global operations.

BEETA ONE is a proficient CA firm in international tax advisory services and international tax consultancy services. We, at BEETA ONE, help organizations with compliance with the prerequisites of international taxation principles, analyze the costs and benefits associated with geographical expansion for our clients, and advise them accordingly. Whether you are a foreign organization intending to expand in India, or vice versa, our team of international tax advisors can assist you in strategizing for these initiatives. We provide compliance in tax reporting obligations, tax strategy assessment, and advance rulings. We undertake a re-evaluation of the existing transfer pricing policy, BEPS risk analysis, and review of financial and operational structures. We also assist clients in cross-border restructuring, litigation before ITAT, High Court, and Supreme Court, and other international tax services to ensure tax-efficient operations and reduction in overall tax burden.

Beetaone Fintax LLP

for a journey beyond excellence.

knowledge. Experience. Teamwork.

International tax advisory services

Tax strategy

GLOBAL INVESTMENT STRUCTURE

Businesses may consider various changes in their transactions to achieve tax efficiency and optimization. At BEETA ONE, our team of international tax advisors identifies the key tax considerations in such transactions to provide maximum benefits for clients. They adopt a global approach to decision-making, offering strategic advice on the best actions to achieve business goals. With proven experience in handling internationally-relevant deal structuring and navigating local tax jurisdictions, our team demonstrates dedication and professionalism in recommending the most suitable choices for achieving tax-efficient outcomes.

IPR HOLDING STRUCTURE

CROSS-BOARDER RESTRUCTINING

Pre-transaction advisory

- Setting up and operation of companies

- Migration of intellectual property

- Utilization of foreign tax credits

- Shifting the base of holding company outside India

- Taxability on branches, project offices, and liaison offices

- Asset transfer transaction between Indian and foreign companies

- Trading transactions in India and related issues of indirect tax

- International tax planning and management

- Taxes and regulatory compliance for international mergers and acquisitions

- Handling the issues of withholding tax when doing business with Indian companies

- Advice on intercompany charges

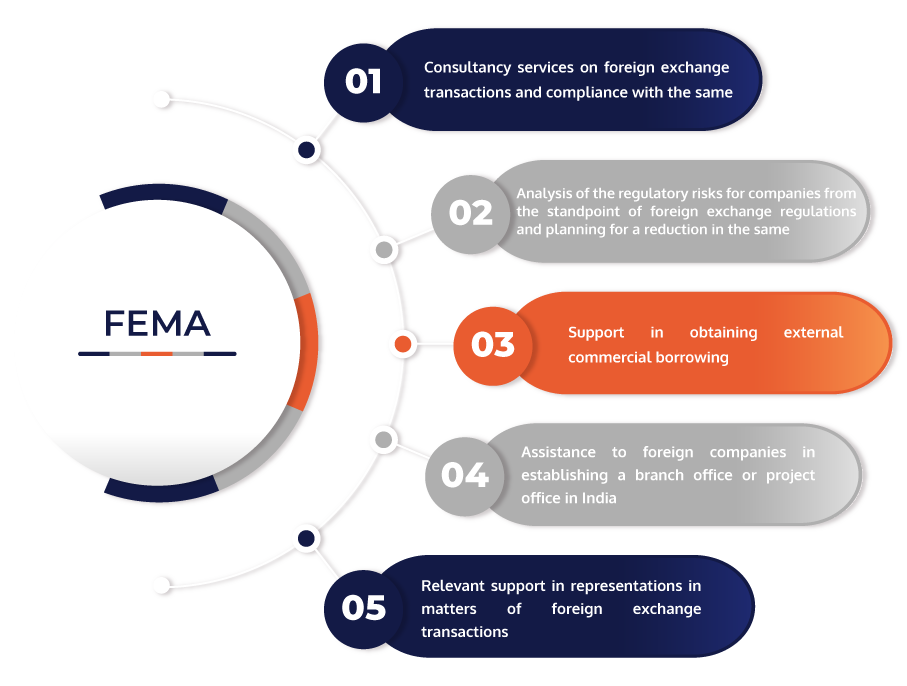

Foreign exchange regulations advisory

BEPS impact analysis

Expatriate arrangement structuring

Compliance & Litigation

INTERNATIONAL TAX COMPLIANCE

SUPPORT FOR LITIGATION AT TRIBUNALS, HIGH COURT, AND SUPER ME COURT

Frequently Asked Questions(FAQ,s)

What is international taxation?

What is BEPS?

Stay ahead in a rapidly changing world. Subscribe to Betaone Fintax LLP Newsletter