Due Diligence Services

INTRODUCTION

Businesses Ought To Make Many Strategic Decisions That Affect Their Operations, Profitability, And Growth In The Years To Come.

BEETA ONE offers due diligence services to assist clients in making informed strategic decisions. Through meticulous research and analysis, we ensure that transactions are feasible, value-generating, and free from potential obstacles or concerns that could impact the company’s success.

At BEETA ONE, we gather all essential information for thorough study and analysis within the agreed timelines, providing our clients with well-informed recommendations. Our careful approach ensures that strategic decisions are made with precision to avoid costly mistakes. Our committed professionals offer due diligence and transaction advisory services covering legal, financial, business, and tax aspects of business operations.

Beetaone Fintax LLP

for a journey beyond excellence.

knowledge. Experience. Teamwork.

Being one of the renowned CA firms in Guntur, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Visit our CA website to understand and know more about our services and our company. Choose us for your business as the best deserves the best.re

DUE DILIGENCE SERVICES

The Various Types Of Due Diligence Services Include:

01

FINANCIAL

In financial due diligence, we analyze financial statements, accounts, and compliances to uncover risks, key revenue and cost items, non-performing segments, and hidden liabilities, ensuring informed decision-making.

Tax risks impact financial transactions, so due diligence assesses tax compliance, profit trends, liabilities, asset valuation, and potential direct or indirect tax implications.

02

LEGAL

Business restructuring involves legal risks, so we analyze assets, contracts, taxes, and intellectual property, while our experts draft agreements aligning legal and business goals.

Our legal experts assist in negotiations, mitigating risks, and drafting secure agreements to optimize cost-benefit outcomes while protecting client interests.

03

CUSTOMER

Customer due diligence identifies and evaluates customer information to mitigate risks like money laundering and terrorism financing. It ensures compliance with legal requirements, protecting businesses from penalties and enhancing risk management.

We support clients with comprehensive KYC checks and ongoing customer monitoring to assess and manage evolving risk profiles. Additional due diligence may be conducted as per the transaction’s requirements.

04

VENDOR

Businesses must assess vendors’ financial stability, operational competence, and corporate governance before agreements to minimize risks to reputation and compliance. This ensures informed decision-making and secure partnerships.

Analyzing vendor relationships is crucial to assess compatibility and identify potential changes that may impact collaboration, enabling companies to secure improved agreements and maintain strong partnerships.

05

M&A

Due Diligence is vital for mergers and acquisitions, helping assess the deal’s feasibility by analyzing the target company’s financials, assets, liabilities, technology, and customer base through expert evaluation.

Due Diligence facilitates informed decision-making by identifying risks and defining a clear structure, enhancing reputation management during business restructuring.

06

TECHNICAL AND OTHER DUE

Evaluating the technical feasibility of a transaction involves assessing the company’s readiness based on technological capabilities, financial resources, and human expertise. Additionally, it may require an investigation into the backgrounds of the promoters, company structure, and ownership. Some transactions necessitate an assessment of both internal and external factors to determine commercial viability. Operational Due Diligence examines daily operations, procedures, internal controls, and business processes to identify any inefficiencies.

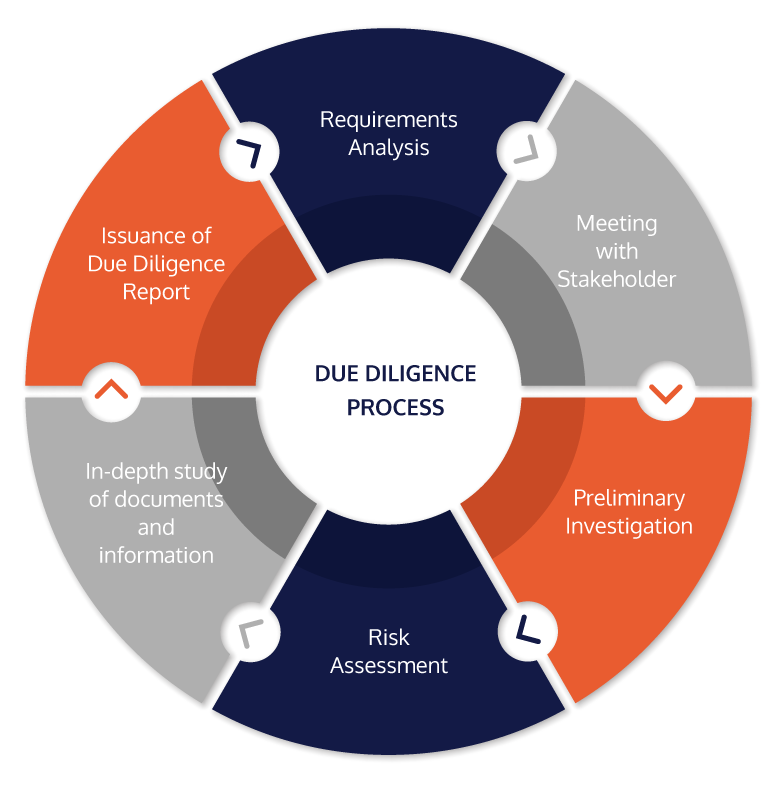

DUE DILIGENCE PROCESS

KEY DIFFERANCE OF BEETA ONE

Our team comprises experts in accounting, taxation, advisory, secretarial, and legal compliance across multiple sectors and jurisdictions, ensuring the highest quality due diligence services for our clients.

Our team of due diligence professionals offers insights into proposed transactions by leveraging client resources, extensive research, and applying industry best practices for execution.

We create comprehensive due diligence reports through our business-focused analysis, helping clients in their strategic decision-making and negotiation processes.

Beeta One’s extensive expertise in various sectors and its hands-on experience empower it to provide valuable services to clients, addressing complex challenges from a strategic, technological, financial, and operational standpoint.

Beeta One’s comprehensive blend of financial insight, commercial understanding, taxation expertise, and knowledge of key management ensures a thorough examination of all transaction facets, essential for its meticulous planning and successful execution.

Beeta One takes its advisory role seriously and, along with the in-house project teams, uncovers all unforeseen aspects of the transaction to offer valuable insights and guidance, supporting its smooth execution.

Frequently Asked Questions(FAQ,s)

What is due Diligence?

Due Diligence is defined as an assessment or audit of a business or a person before entering into any agreement or contract with that business or person. Due Diligence involves research and analysis of a subject to identify any risks or concerns that it currently has or which are expected in the future. It is conducted before entering into a transaction like acquisition, merger, funding, business partnership, or investment.

What is a due diligence report? What are its contents?

The team involved in the study and evaluation of the transaction prepare a report with all the details required to make the final decision regarding the transaction. This report is called the due diligence report.

The key information included in a due diligence report contains information about the company profile, financial information, employment and labor, infrastructure, agreements, supplier’s data, customer’s data, and legal information.

The company profile includes key details such as the company name, registered address, business form, and shareholders with their shareholding percentages. Financial information consists of audited financial statements, tax returns, financial forecasts, and board presentations. Employment details include senior management biographies, employee designations, and HR policies. Additionally, legal and infrastructure information covers licenses, litigation, real estate, and supplier/customer data.

What is a due diligence checklist?

A list of all the items/factors that the evaluator intends to study and assess in the due diligence process is a due diligence checklist. The key items that feature in this list include company profiling, taxes, contracts, employees list, list of vendors, intellectual property, material assets, contracts, litigation, and compliance matters.

Stay ahead in a rapidly changing world. Subscribe to Betaone Fintax LLP Newsletter