DTAA Advisory Services

DTAA Advisory Services

BEETA ONE is one of the renowned DTAA advisory services providers in GUNTUR.

At BEETA ONE, we assist you in navigating through complex taxation uncertainties. Our DTAA consultants bring extensive experience in handling DTAA Advisory Services, optimizing tax liabilities for income and profits earned overseas. Our proficient team of DTAA advisors stays updated on global tax and accounting issues, ensuring seamless management of clients’ international transactions.

What is DTAA

It is a globalized world.

Businesses are increasingly looking for opportunities to expand beyond India to broaden their reach and achieve exponential growth. This has led to a rise in cross-border transactions for globalized companies.

However, this growth also brings challenges related to taxation and accounting, particularly the risk of income being subject to double taxation across different tax regimes. Double Taxation Avoidance Agreements (DTAAs) serve as crucial tools for businesses to mitigate these issues. At BEETA ONE, we provide comprehensive DTAA Advisory Services to support our clients in navigating these complexities and ensuring compliance with legal provisions.

When conflicting rules between two countries arise regarding residential status and the taxability of income, challenges emerge in the calculation and payment of taxes. The absence of a common international framework for computing income or taxes in cross-border transactions often results in overlapping tax laws, leading to the risk of double taxation. This is where Double Taxation Avoidance Agreements (DTAAs) become essential, helping businesses and individuals navigate and mitigate such complexities. At BEETA ONE, we provide expert DTAA Advisory Services to ensure compliance and optimize tax efficiency across borders.

DTAAs between two countries provide relief from dual taxation, making the country more appealing for non-resident individuals and companies looking to work and operate there. By mitigating the risk of double taxation, DTAAs foster a conducive environment for economic growth, trade, and investment between the agreeing countries, promoting cross-border business activities. At BEETA ONE, we offer expert DTAA Advisory Services to guide businesses through these complex agreements and ensure compliance with international tax standards.

There are two types of DTAAs:

- Comprehensive DTAAs are the ones covering almost all types of incomes.

- While Limited DTAAs are the ones covering only certain types of incomes.

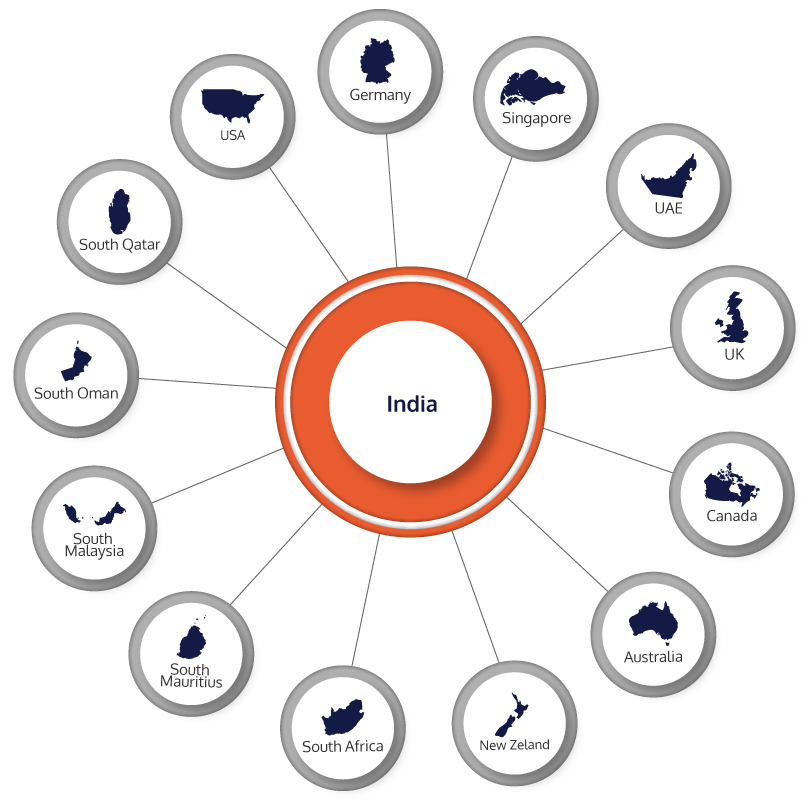

India has entered into DTAA with many countries:

The tax relief provided by DTAAs can be in two forms: a tax credit or exemption. A tax credit offsets the tax paid abroad against the tax liability in the country of residence, while an exemption eliminates the tax liability for income earned in a foreign country. Depending on the agreement, DTAAs may cover specific taxes or all taxes. At BEETA ONE, we offer expert DTAA Advisory Services to help clients efficiently manage cross-border taxation and maximize their benefits.

Beetaone Fintax LLP

for a journey beyond excellence.

knowledge. Experience. Teamwork.

Being one of the renowned CA firms in Guntur, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Visit our CA website to understand and know more about our services and our company. Choose us for your business as the best deserves the best.re

DTAA Consulting Services

BEETA ONE provides its clients with expert DTAA advisory and consulting services. We ensure that the data on incomes are effectively managed, and calculations for tax are correctly done to avoid double taxation.

BEETA ONE also assists its clients by recommending various measures to maximize rebates, exemptions, and deductions under the applicable tax laws. Our DTAA advisors ensure that clients receive top-quality services for tax return preparation in both countries involved in DTAA transactions.

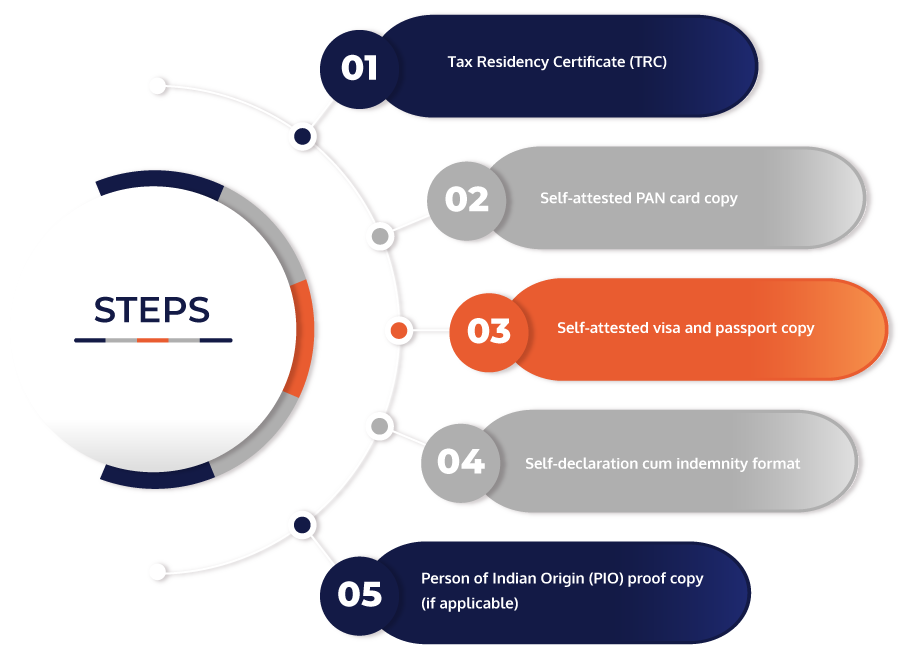

its clients in the structuring of salary to minimize Direct tax liabilities, determining the personal investment strategy for achieving the highest tax efficiency, and claiming foreign tax credit on dual-income returns. We assist BEETA ONE’s clients in getting the required documentation ready for these transactions.

These documents include:

HOW TO TAKE DTAA BENEFITS

As per the provisions of DTAA, NRIs need not pay tax twice on the following income earned from India:

Service Income

Salary Income

Income from House Property

Capital Gains on the transfer of assets

Fixed Deposits and Savings Bank account

Frequently Asked Questions(FAQ,s)

What is double taxation?

When two or more countries impose a tax on the same income, financial transaction, or asset, it is called double taxation.

What is DTAA in income tax?

DTAA means the Double Taxation Avoidance Agreement. As the name suggests, to avoid imposing tax twice on the same income, two or more countries where the incidence of tax occurs and where the individual/company is a resident, sign a tax agreement. According to the DTAA, the countries agree on the tax rates for stated jurisdictions for specified types of income. DTAA signed between two countries becomes applicable when a taxpayer resides in one country and earns income in another country.

How many countries have DTAA with India?

India has DTAA with more than 80 countries in the world.

How does DTAA work in India?

In a DTAA signed by India with another country, a specific rate is fixed at which tax has to be deducted from the income paid to the residents of that country. If an NRI earns income in India, the income would be taxed at the rate fixed in the DTAA with the country in which the NRI is based now.

What are the DTAA benefits?

The DTAA benefits include credits for taxes paid on the doubly-taxed income that can be encashed at a later date, lower TDS, and exemption from tax.

What is a TRC? Why is it needed?

TRC is a Tax Residence Certificate. It is a document provided by the authority of the treaty partner to confirm to the authorities of one’s country of residence. Non-residents of India seeking tax benefits under DTAA must furnish it to the authorities. This document was introduced as a mandatory requirement to avoid fake claims for tax benefits under the treaty.

Stay ahead in a rapidly changing world. Subscribe to Betaone Fintax LLP Newsletter