Concurrent Audit Services

Concurrent Audit Services

The activities of mutual fund houses, financial institutions, and especially banks and their risk profiles are growing complex day by day.

What is Concurrent Audit Services ?

Objectives of concurrent audit

Ensuring timeliness and accuracy in maintaining the company's or bank's books of accounts and periodical financial statements.

To improve transparency by implementing vouchers or evidence-based payments in the company or bank.ts.

To improve the internal control system of the entity.

To ensure that the system, rules, regulations, policies, and procedures are followed properly by the company in line with the compliance requirements.

Concurrent audit scope

Review of internal controls to check if they are adequate, considering the nature and size of the business and pinpointing areas requiring more stringent controls.

Verification of KYC, AML, TDS documents as per RBI and Ministry of Finance guidelines

Substantive checking of high- risk areas like credit, regulatory compliance, revenue, non- performing assets, and forex.

Bringing into the light any violation of rules, regulations, and procedures or any hidden fraud happening in the company.

Identifying inefficiencies at operational levels and detecting sources of leakage of income, if any.

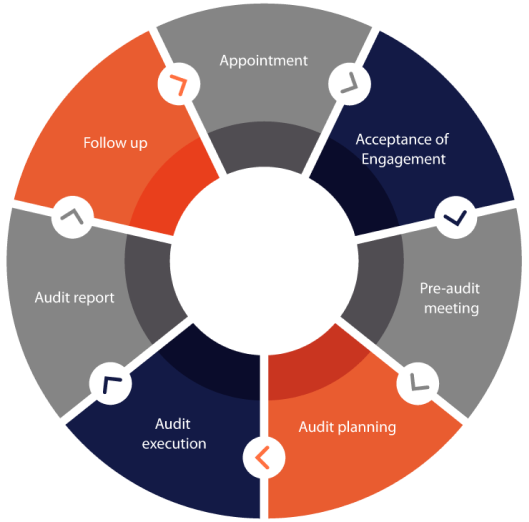

CONCURRENT AUDIT PROCESS

Benefits of concurrent auditing

Qualified professionals

Time saver

Differences between internal auditing and concurrent auditing

Why choose Betaone Fintax LLP for concurrent auditing?

Stay ahead in a rapidly changing world. Subscribe to Beetaone Fintax LLP Newsletter