Tax Audit

Tax Audit

Tax audit is an independent review of books of accounts of an entity by auditors required under the Income Tax Act, 1961.

Tax auditing and timely filing of tax returns with transparency and accurate records are crucial for any assessee subject to audit. Beetaone Fintax LLP we serve as your trusted partner in this important process. Our team of experienced and dedicated auditors provides value-added services to

ensure your accounts are handled with the utmost care. We understand the sensitivity and significance of tax matters for businesses and individuals,

and we uphold the highest ethical standards while delivering top-notch quality in every service we provide. You can rely on us to navigate the

complexities of tax auditing with precision and transparency.

What is tax audit?

A tax audit is an examination of a taxpayer’s financial records, accounts, and tax returns by an authorized professional, usually a chartered accountant, to ensure compliance with the tax laws and regulations. It involves verifying the accuracy of income, expenses, and other financial transactions, and ensuring that taxes are properly paid. The audit assesses if the taxpayer has accurately reported their taxable income, deductions, and credits, and ensures that tax returns are filed correctly, in line with the applicable laws.

At Beetaone Fintax LLP, we are always here to provide you with exceptional accounting, auditing, and financial

advisory services tailored to your unique business needs. Whether you’re looking for expert guidance in GST

compliance, transfer pricing, RBI/FEMA regulations, or accounting outsourcing, our team of dedicated professionals

is just a call or email away.

Tax Audit Applicability

A taxpayer, whether in business or professional has to get a tax audit done if his turnover/receipts exceed tax audit limits as defined below:

Turn over limit for Business

A tax audit is a process required under the Income Tax Act for taxpayers in India whose annual gross

turnover or receipts exceed certain thresholds. For businesses, if the turnover exceeds Rs. 1 Crore, a

tax audit is mandatory. However, for taxpayers opting for presumptive taxation under Section 44AD,

the audit limit is Rs. 2 Crore. Additionally, for taxpayers whose cash transactions (both receipts and

payments) do not exceed 5% of the total receipts and payments, the tax audit limit is increased to

Rs. 5 Crore from the financial year 2019-20. During the audit, an independent tax auditor verifies the

taxpayer’s financial records, ensuring transparency, compliance with tax regulations, and accurate

filing of tax returns.

Gross receipt limit for Professionals

If the annual gross receipts in a profession exceed Rs. 50 Lakh, the assessee is required to undergo a

tax audit under Section 44AA of the Income Tax Act. This is applicable to individuals, Hindu Undivided

Families (HUFs), or businesses engaged in professions such as legal, medical, engineering, technical

consultancy, accountancy, interior designing, etc. The purpose of this audit is to ensure that the financial

records are accurate, tax returns are filed correctly, and the taxpayer is in compliance with the provisions

of the Income Tax Act.

Further, the audit is also required in cases where the taxpayer is declaring lower net profit while declaring profit U/s 44AD, 44ADA, 44AE.

Tax Audit Due Date

The assessee is required to file an audit report by 30th September of the assessment year.

Tax Audit Penalty

As per Section 271B of the Income Tax Act 1961, the penalty for non-filing of the audit report is lower of:

- 0.5% of the total sales, turnover, or gross receipt

- Rs. 1,50,000

Tax audit objectives

Ensuring proper maintenance and correctness of books of accounts and its certification by a Chartered Accountant

Identification of discrepancies in the books of accounts by an auditor so that the same can be corrected and accurate accounts can be maintained.

Providing the required information, including tax deductions, depreciation, and compliance with various provisions of the law in the report format prescribed by the tax authorities.

Ensuring that the tax return is accurate and it is correctly filed as per provisions of the Income Tax Act.

Tax auditing

We firmly believe that our clients are our biggest assets, and when it comes to providing customer-centric services, we make sure to stand in their shoes and deliver exactly what they need. We understand that you are looking for an auditor who dives deep into the intricacies of the Indian tax system, understanding all rules, regulations, and complex laws. Our team of tax professionals draws expertise from diverse sources and years of knowledge, ensuring a seamless tax auditing and tax compliance service for our clients.

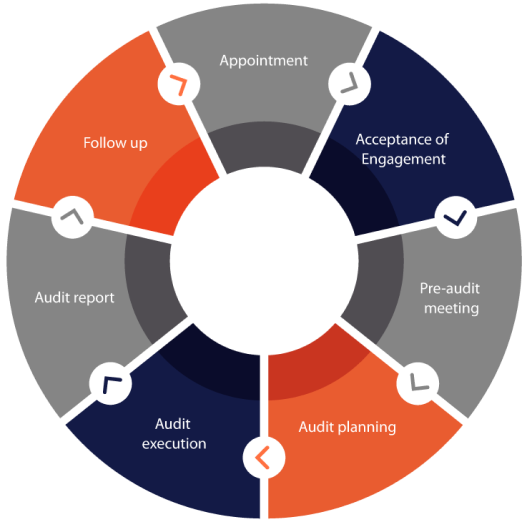

The Process

Stay ahead in a rapidly changing world. Subscribe to Beetaone Fintax LLP Newsletter